Housing Forecasts via Stock Market Indicators

Varun Mittalaand Laura P. Schaposnik?,b,

(?) Corresponding author: schapos@uic.edu

Through the reinterpretation of housing data as candlesticks, we extend Nature Scientific Reports

article by Liang and Unwin [LU22] on stock market indicators for COVID-19 data, and utilize some

of the most prominent technical indicators from the stock market to estimate future changes in

the housing market, comparing the findings to those one would obtain from studying real estate

ETF’s. By providing an analysis of MACD, RSI, and Candlestick indicators (Bullish Engulfing,

Bearish Engulfing, Hanging Man, and Hammer), we exhibit their statistical significance in making

predictions for USA data sets (using Zillow Housing data) and also consider their applications within

three different scenarios: a stable housing market, a volatile housing market, and a saturated market.

In particular, we show that bearish indicators have a much higher statistical significance then bullish

indicators, and we further illustrate how in less stable or more populated countries, bearish trends

are only slightly more statistically present compared to bullish trends.

Keywords: Stock market indicators, housing market, trend study

I. INTRODUCTION

The mathematical study of housing markets dates back

to the 1970s [Kir76], and its prominence has seen a sig-

nificant increase in the last decades, as consumers are

increasingly looking at the right time to make a signifi-

cant investment [GLB19]. Whilst classical studies have

included complex models and economic examinations to

varying levels of success [Car89], after the housing market

crashed in 2008 it became clear that new models are nec-

essary to understand both the local and global behaviour

of housing markets. Since then, more novel approaches

begun to be implemented [Kha08], but these are yet to

become as robust or successful as they could potentially

be [KM71]. Purchasing a house is never easy, and buying

at the optimal time is a significant decision. As a result

of COVID, the housing market has become more volatile

and has fluctuated significantly [LS21]. Therefore, we

propose the utilization of technical indicators that are

commonly applied in the stock market to the housing

markets to identify both bearish and bullish trends in

the housing market, where

(a) a trend is considered bullish if it is corresponds to

an increase in value for a time series.

(b) a trend is considered bearish if it corresponds to

a decrease in value for a time series.

In a recent Nature Scientific Reports article, Liang and

Unwin proposed to use stock market indicators to under-

stand trends in COVID-19 cases in the US [LU22]. In-

spired by this work, we shall consider Zillow’s data set of

the USA’s housing market and study it through examin-

ing the usability of statistical indicators usually seen in

the stock market such as MACD Bearish, MACD Bullish,

RSI Bearish, RSI Bullish, Hanging Man, and Hammer.

These indicators can be used to identify trends (both

bearish and bullish) that can be vital when it comes to

house purchasing decisions. In what follows we shall show

via these indicators, trends (both bearish and bullish) can

be detected and used to understand housing prices.

For each indicator we calculate the statistical signif-

icance using the Wilcoxon test, and show in particular

that while both RSI indicators were statistically signifi-

cant, only the bearish indicator is significant for MACD.

Finally, we extend our analysis to other countries, with

the intent of being able to make insights in various types

of markets. To be encompassing and robust, we consid-

ered different types of markets (Saturated, Volatile and

Stable) and studied the relevance of the indicators within

each setting. In particular, we show that

•across all countries, bearish indicators were much

more statistically significant compared to bullish

indicators, for the vast majority of indicators..

•the difference in the statistical significance of

bullish and bearish trends isn’t nearly as large in

saturated and volatile housing markets.

•when using sock market indicators directly on hous-

ing prices, the trends of the housing price can be

predicted more accuratedly than when considering

the indicators on housing ETFs.

To carry out our study, we considered RSI, MACD,

and Candlestick Analysis conducted through R. After

grouping grouping Zillow’s data [zil21] into Heikin Ashi

candlesticks, we scanned the data for the four candle-

stick indicators mentioned above and used the Wilcox,

and later performed a similar procedure for the other in-

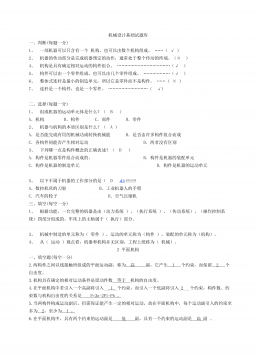

dicators. After introducing some background in Section

II, we dedicate Section Vand Section VI to the main

findings of our work, which can be seen in two different

directions in terms of the indicators themselves and their

statistical significance in various markets. To highlight

the utility of our approach vs any standard stock mar-

ket study of Housing ETFs, we compared our findings

to what one can deduce through the same indicators on

the most used Housing ETFs, namely VNQ (Vanguard

Real Estate ETF), SCHH (Schwab US REIT ETF), and

XLRE (Real Estate Select Sector SPDR Fund) in Section

??. Finally, we expand on the analysis and applications

of the above findings in Section VII. Finally, we also at-

tached our code for the project on Github [MS22].

arXiv:2210.10146v1 [econ.GN] 18 Oct 2022

2024-11-15 27

2024-11-15 27

2024-11-15 16

2024-11-15 16

2025-04-07 11

2025-04-07 11

2025-04-07 7

2025-04-07 7

2025-04-07 11

2025-04-07 11

2025-04-07 7

2025-04-07 7

2025-04-07 8

2025-04-07 8

2025-04-07 6

2025-04-07 6

2025-04-07 8

2025-04-07 8

2025-04-07 11

2025-04-07 11

渝公网安备50010702506394

渝公网安备50010702506394