Prediction intervals for economic fixed-event forecasts Fabian Kr uger Karlsruhe Institute of TechnologyHendrik Plett

Predictionintervalsforeconomicfixed-eventforecasts∗FabianKr¨ugerKarlsruheInstituteofTechnologyHendrikPlettETHZ¨urichMarch21,2024AbstractThefixed-eventforecastingsetupiscommonineconomicpolicy.Itinvolvesasequenceofforecastsofthesame(‘fixed’)predictand,sothatthedifficultyoftheforecastingproblemdecrease...

相关推荐

-

2021 年全国硕士研究生入学统一考试英语(一)试题及参考答案VIP免费

2024-12-02 4

2024-12-02 4 -

2016年一级注册消防工程师消防安全案例分析VIP免费

2024-12-03 7

2024-12-03 7 -

2017年注册消防工程师案例分析真题解析VIP免费

2024-12-03 4

2024-12-03 4 -

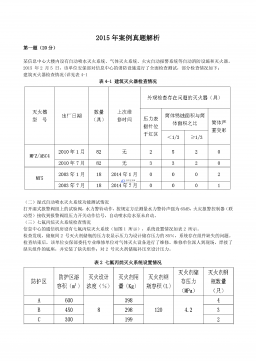

2015年注册消防工程师案例真题解析VIP免费

2024-12-03 32

2024-12-03 32 -

2019年注册消防工程师案例分析真题解析VIP免费

2024-12-03 34

2024-12-03 34 -

消防综合能力真题按章节版(2015-2019年)VIP免费

2024-12-03 15

2024-12-03 15 -

消防技术实务真题按章节版(2015-2019)VIP免费

2024-12-03 13

2024-12-03 13 -

2018年注册消防工程师案例分析真题解析VIP免费

2024-12-03 23

2024-12-03 23 -

2006年中央、国家机关公务员录用考试行政职业能力测试真题及答案解析(A类)【完整+答案+解析】VIP免费

2024-12-13 119

2024-12-13 119 -

2008年0706河南公务员考试《行测》真题VIP免费

2025-02-25 9

2025-02-25 9

作者详情

相关内容

-

2007年天津市公务员考试《行测》真题(春季卷)答案及解析

分类:

时间:2025-02-07

标签:无

格式:PDF

价格:5.9 玖币

-

2005年江苏省公务员考试《行测》真题(B类卷)答案及解析

分类:

时间:2025-02-07

标签:无

格式:PDF

价格:5.9 玖币

-

2010年广东公务员考试《行测》真题(部分题目缺失)

分类:

时间:2025-02-25

标签:无

格式:PDF

价格:5.9 玖币

-

2010年北京公务员考试《行测》真题

分类:

时间:2025-02-25

标签:无

格式:PDF

价格:5.9 玖币

-

2008年0706河南公务员考试《行测》真题

分类:

时间:2025-02-25

标签:无

格式:PDF

价格:5.9 玖币

渝公网安备50010702506394

渝公网安备50010702506394