P2P

P2P

P2P

P2P

P2P

P2P

P2B

P2B

P2B

P2B

P2B

P2B

P2B

INVITES

INVITES

INVITES

INVITES

INVITES

INVITES

INVITES

INVITES

INVITES

P2P

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2P

P2B

P2B

P2B

P2B

INVITES

INVITES

P2P

P2P

P2P

P2P

P2P

P2P

P2P

P2P

P2P

P2P

P2B

P2B

P2B

P2B

P2B

INVITES

P2P

P2P

P2P

P2P

P2P

P2P

INVITES

P2P

P2B

P2P

P2P

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2P

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

INVITES

P2P

INVITES

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

P2B

INVITES

INVITES

P2P

P2P

P2P

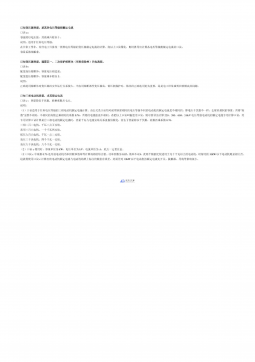

Fig. 1: A small portion of the dataset. Users and merchants are

represented as orange and blue nodes, respectively. Invitations

among users are represented with bold orange links, P2B

transactions correspond to blue links, P2P money transfers are

displayed in green.

and to exchange money with each other. We applied our

methodology to analyze the YAP platform’s community, with

the goal of supporting business decisions. Our results show

that the approach is a practical tool to support marketing

campaigns and, more in general, business decisions.

II. DATASET AND ITS GRAPH REPRESENTATION

To develop and evaluate our methodology, we take a data-

driven approach and use as a reference a dataset collected

from an operational payment platform. The dataset comes

from the Italian app YAP1, a payment platform provided by

Nexi2, one of the biggest European players in digital payments.

YAP is based on a mobile application linked to a prepaid

card (accepted by online and physical stores) that also allows

its customers to exchange money with friends and contacts

without fees. In this paper, we use data from the production

databases of YAP, which include a set of transactions for the

years 2019, 2020 and 2021, as well as metadata about users

and merchants.

The dataset can be naturally represented in terms of a

heterogeneous graph, since there are entities that are related

to each other. In particular, we have identified three types of

relationships that reflect the three main types of interactions

between users and merchants.

1https://www.yap-app.it

2https://www.nexigroup.com/en/

1) Users are connected to merchants by “P2B” relation-

ships, representing monetary transactions characterized

by their date, amount and channel, which may be online

(i.e., e-shops) or offline (i.e., physical stores).

2) Users may transfer money to other users. This kind of

interaction is represented by “P2P” relationships among

users, which are characterized by their date and amount.

3) Finally, users may invite new users to join the platform.

This results in “Invite” relationships, whose tail and

head nodes correspond to users sending and accepting

the invitation, respectively. Note that we only model

invitations that resulted in the acquisition of a new users.

These relationships are characterized by a timestamp. Hence

we have a dynamic graph, with edges appearing and disap-

pearing over different time windows.

We sketch a small portion on this heterogeneous graph

in Figure 1, where users and merchants are connected with

three types of edges. For privacy reasons, we anonymize the

dataset by removing personally identifiable information. As a

result, users and merchants are identified by unique numeric

identifiers. Each user is associated with some personal details

(age, gender, place of residence, occupation), while merchants

are characterized by a category indicating the type of activity

and the province of their retail store.

We store our dataset in the graph database Neo4j3, which

provides a native representation of graph data, so we could

efficiently traverse the graph, query it for patterns and visualize

the resulting information. The dataset is quite large and

includes a number of nodes in the range (106,107)and a

number of relationships in the range (107,108).4

For our methodology, the “Invitation Network” plays a rele-

vant role. It simply represents the network of users connected

by the “Invite” relationships. Formally, we define it as the

subgraph G= (V,E)of our dataset comprising all users Vand

the invitation relationships among them.5The edges Ethen

represent the “Invite” relationships among couples of nodes

(u, v)∈ E ⊂ V × V. The Invitation Network Gplays a key

role in the development of our methodology, as it captures the

temporal evolution of the YAP network in terms of new users

acquired through accepted invitations. We therefore briefly

characterize its main topological features. First, we note that

the invitation graph has a special structure: Gis a forest, i.e.,

each weakly connected component (WCC) of Gis a directed

tree, since each user can send many invitations but he can

accept only one. An example of a WCC from the dataset is

shown in Figure 2. The top user sent several invitations, 8 of

which were accepted. Some users in turn invited other users,

forming a WCC with a total of 34 users. The size of the WCCs

varies from small single-user or two-user components (none

or a single accepted invitation) to subgraphs with hundreds

of users. In Figure 3, we show the distribution of WCC size

in terms of a complementary cumulative distribution function

3https://neo4j.com

4We cannot disclose the exact numbers and ranges as they represent trade

secrets.

5Merchants cannot invite neither users or other merchants to the platform.

2024-11-15 27

2024-11-15 27

2024-11-15 16

2024-11-15 16

2025-04-07 11

2025-04-07 11

2025-04-07 7

2025-04-07 7

2025-04-07 11

2025-04-07 11

2025-04-07 7

2025-04-07 7

2025-04-07 8

2025-04-07 8

2025-04-07 6

2025-04-07 6

2025-04-07 8

2025-04-07 8

2025-04-07 11

2025-04-07 11

渝公网安备50010702506394

渝公网安备50010702506394