Bootstrap in High Dimension with Low Computation

in deriving finite-sample CLT errors for technicality reasons.

Our bounds shed light that, at least for this wide class of

models, using a small number of resamples can achieve a

good coverage even in a dimension pgrowing closely with

n.

Bootstrap Bounds on Linear Models Independent of

p

:

We further specialize our bounds to linear functions with

weaker tail conditions, which have orders independent of

p

under certain conditions on the

Lp

norm or Orlicz norm of

the linearly scaled random variable.

In addition to theoretical bounds, we investigate the empiri-

cal performances of bootstraps using few resamples on large-

scale problems, including high-dimensional linear regres-

sion, high-dimensional logistic regression, computational

simulation modeling, and a real-world data set RCV1-v2

(Lewis et al.,2004). To give a sense of our comparisons

that support using the cheap bootstrap in high dimension,

here is a general conclusion observed in our experiments:

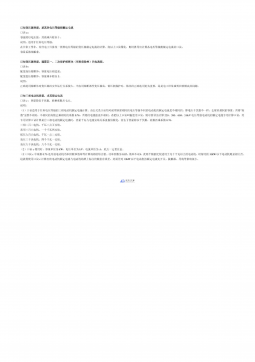

Figure 1(a) shows the coverage probabilities of

95%

-level

confidence intervals for three regression coefficients with

corresponding true values

0,2,−1

in a 9000-dimensional

linear regression (in Section 4). The cheap bootstrap cov-

erage probabilities are close to the nominal level

95%

even

with one resample, but the basic and percentile bootstraps

only attain around

80%

coverage with ten resamples. In

this example, one Monte Carlo replication to obtain each

resample estimate takes around 4 minutes in the virtual ma-

chine e2-highmem-2 in Google Cloud Platform. Therefore,

the cheap bootstrap only requires 4 minutes to obtain a sta-

tistically valid interval, but the standard bootstrap methods

are still far from the nominal coverage even after more than

a 40-minute run. Figure 1(b) shows the average interval

widths. This reveals the price of a wider interval for the

cheap bootstrap when the Monte Carlo budget is very small,

but considering the low coverages in the other two methods

and the fast decay of the cheap bootstrap width for the first

few number of resamples, such a price appears secondary.

Notation. For a random vector

X

, we write

Xk

as the ten-

sor power

X⊗k

. The vector norm is taken as the usual

Euclidean norm. The matrix and tensor norms are taken

as the operator norm. For a square matrix

M

,

tr(M)

de-

notes the trace of

M

.

Ip×p

denotes the identity matrix in

Rp×p

and

1p

denotes the vector in

Rp

whose components

are all

1

.

Φ

denotes the cumulative distribution function of

the standard normal.

C2(Rp)

denotes the set of twice con-

tinuously differentiable functions on

Rp

. Throughout the

whole paper, we use

C > 0

(without subscripts) to denote

a universal constant which may vary each time it appears.

We use

C1, C2, . . .

to denote constants that could depend on

other parameters and we will clarify their dependence when

using them.

2. Background on Bootstrap Methods

We briefly review standard bootstrap methods and from

there the recent cheap bootstrap. Suppose we are interested

in estimating a target statistical quantity

ψ:= ψ(PX)

where

ψ(·) : P 7→ R

is a functional defined on the probability mea-

sure space

P

. Given i.i.d. data

X1, . . . , Xn∈Rp

following

the unknown distribution

PX

, we denote the empirical dis-

tribution as

ˆ

PX,n(·) := (1/n)Pn

i=1 I(Xi∈ ·)

. A natural

point estimator is ˆ

ψn:= ψ(ˆ

PX,n).

To construct a confidence interval from

ˆ

ψn

, a typical be-

ginning point is the distribution of

ˆ

ψn−ψ

from which we

can pivotize. As this distribution is unknown in general,

the bootstrap idea is to approximate it using the resample

counterpart, as if the empirical distribution was the true

distribution. More concretely, conditional on

X1, . . . , Xn

,

we repeatedly, say for

B

times, resample (i.e., sample

with replacement) the data

n

times to obtain resamples

{X∗b

1, . . . , X∗b

n}, b = 1, . . . , B

. Denoting

ˆ

P∗b

X,n

as the re-

sample empirical distributions, we construct

B

resample

estimates

ˆ

ψ∗b

n:= ψ(ˆ

P∗b

X,n)

. Then we use the

α/2

and

(1 −α/2)

-th quantiles of

ˆ

ψ∗b

n−ˆ

ψn

, called

qα/2

and

q1−α/2

,

to construct

[ˆ

ψn−q1−α/2,ˆ

ψn−qα/2]

as a

(1 −α)

-level

confidence interval, which is known as the basic bootstrap

(Davison & Hinkley (1997) Section 5.2). Alternatively, we

could also use the

α/2

and

(1−α/2)

-th quantiles of

ˆ

ψ∗b

n

, say

q′

α/2

and

q′

1−α/2

, to form

[q′

α/2, q′

1−α/2]

, which is known as

the percentile bootstrap (Davison & Hinkley (1997) Section

5.3). There are numerous other variants in the literature,

such as studentization (Hall,1988), calibration or iterated

bootstrap (Hall,1986a;Beran,1987), and bias correction

and acceleration (Efron,1987;DiCiccio et al.,1996;DiCic-

cio & Tibshirani,1987), with the general goal of obtaining

more accurate coverage.

All the above methods rely on the principle that

ˆ

ψn−ψ

and

ˆ

ψ∗

n−ˆ

ψn

(conditional on

X1, . . . , Xn

) are close in distri-

bution. Typically, this means that, with a

√n

-scaling, they

both converge to the same normal distribution. In contrast,

the cheap bootstrap proposed in Lam (2022a;b) constructs a

(1 −α)-level confidence interval via

hˆ

ψn−tB,1−α/2Sn,B ,ˆ

ψn+tB,1−α/2Sn,B i,(1)

where

S2

n,B = (1/B)PB

b=1(ˆ

ψ∗b

n−ˆ

ψn)2

, and

tB,1−α/2

is

the

(1 −α/2)

-th quantile of

tB

, the

t

-distribution with de-

gree of freedom

B

. The quantity

S2

n,B

resembles the sample

variance of the resample estimates

ˆ

ψ∗b

n

’s, in the sense that as

B→ ∞

,

S2

n,B

approaches the bootstrap variance

V ar∗(ˆ

ψ∗

n)

(where

V ar∗(·)

denotes the variance of a resample condi-

tional on the data). In this way,

(1)

reduces to the normality

interval with a “plug-in” estimator of the standard error term

when

B

and

n

are both large. However, intriguingly,

B

does

not need to be large, and

S2

n,B

is not necessarily close to

2

2024-11-15 27

2024-11-15 27

2024-11-15 16

2024-11-15 16

2025-04-07 11

2025-04-07 11

2025-04-07 7

2025-04-07 7

2025-04-07 11

2025-04-07 11

2025-04-07 7

2025-04-07 7

2025-04-07 8

2025-04-07 8

2025-04-07 6

2025-04-07 6

2025-04-07 8

2025-04-07 8

2025-04-07 11

2025-04-07 11

渝公网安备50010702506394

渝公网安备50010702506394