Statistical inference for rough volatility Central limit theorems

arXiv:2210.01216v3[math.ST]14Jun2024STATISTICALINFERENCEFORROUGHVOLATILITY:CENTRALLIMITTHEOREMSBYCARSTENH.CHONG1,a,MARCHOFFMANN2,b,YANGHUILIU3,c,MATHIEUROSENBAUM4,dANDGRÉGOIRESZYMANSKI4,e1DepartmentofInformationSystems,BusinessStatisticsandOperationsManagement,TheHongKongUniversityofScienceandTechno...

相关推荐

-

安2-安3,26-21灌浆施工组织设计VIP免费

2024-11-22 10

2024-11-22 10 -

XX水电站导流洞施工组织措施VIP免费

2024-11-22 11

2024-11-22 11 -

xx公路施工组织设计VIP免费

2024-11-22 12

2024-11-22 12 -

xx电站施工组织设计(投标阶段)VIP免费

2024-11-22 12

2024-11-22 12 -

XXX土地开发整理项目投标文件 施工组织设计VIP免费

2024-11-22 17

2024-11-22 17 -

pccp管穿河施工组织设计VIP免费

2024-11-22 12

2024-11-22 12 -

110kv水利变电站施工组织设计VIP免费

2024-11-22 13

2024-11-22 13 -

7套水电安装精选施工组织设计VIP免费

2024-11-22 14

2024-11-22 14 -

×××供水工程施工组织设计VIP免费

2024-11-22 18

2024-11-22 18 -

XX县城防堤施工组织设计1VIP免费

2024-11-22 15

2024-11-22 15

作者详情

相关内容

-

电力工程资料:(一)目录

分类:建筑/施工

时间:2025-06-07

标签:无

格式:PDF

价格:10 玖币

-

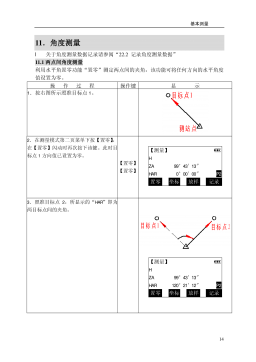

电力工程资料:(四)基本测量

分类:建筑/施工

时间:2025-06-07

标签:无

格式:PDF

价格:10 玖币

-

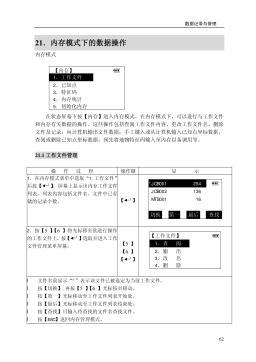

电力工程资料:(六)数据记录

分类:建筑/施工

时间:2025-06-07

标签:无

格式:PDF

价格:10 玖币

-

电力工程资料:(九)其他

分类:建筑/施工

时间:2025-06-07

标签:无

格式:PDF

价格:10 玖币

-

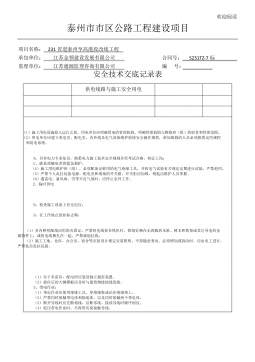

电力工程资料:(完整word版)电力安全技术交底

分类:建筑/施工

时间:2025-06-07

标签:无

格式:DOCX

价格:10 玖币

渝公网安备50010702506394

渝公网安备50010702506394