2012年12月英语六级真题(2)

2012年12月大学英语六级(CET-6)真题试卷PartIWriting(30minutes)Direction:Forthispart,youareallowed30minutestowriteanessayentitledManandComputerbycommentingonthesaying,"Therealdangerisnotthatthecomputerwillbegintothinklikeman,butthatmanwillbegintothinklikethecomputer."Youshouldwriteatleast150wordsbutnomorethan200wo...

相关推荐

-

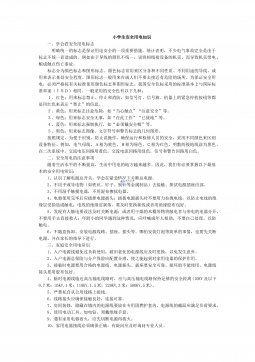

小学生交通安全常识VIP免费

2024-12-01 8

2024-12-01 8 -

小学生公共场所礼仪VIP免费

2024-12-01 8

2024-12-01 8 -

小学生歌曲优美歌词摘抄VIP免费

2024-12-01 7

2024-12-01 7 -

小学生必看的十部电影VIP免费

2024-12-01 12

2024-12-01 12 -

小学生安全用电知识VIP免费

2024-12-01 13

2024-12-01 13 -

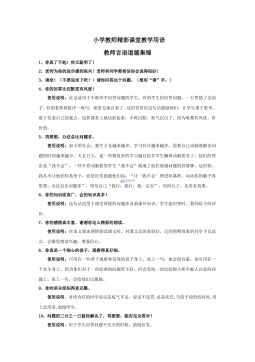

小学教师精彩课堂教学用语教师言语道德集锦VIP免费

2024-12-01 31

2024-12-01 31 -

小学1-6年级语文常识、名言名句、成语、谚语、歇后语大汇总VIP免费

2024-12-01 25

2024-12-01 25 -

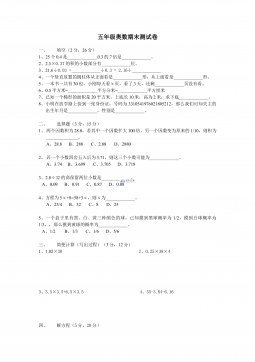

五年级奥数期末测试卷VIP免费

2024-12-01 29

2024-12-01 29 -

六年级计算题的复习与回顾练习VIP免费

2024-12-01 12

2024-12-01 12 -

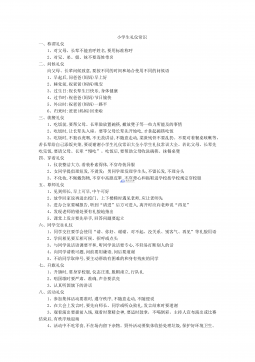

小学生礼仪常识VIP免费

2024-12-01 22

2024-12-01 22

作者详情

相关内容

-

小学二年级上册上学期-部编版语文:寒号鸟 预习笔记

分类:幼儿/小学教育

时间:2025-08-25

标签:无

格式:PDF

价格:10 玖币

-

小学二年级上册上学期-部编版语文:古诗二首预习笔记

分类:幼儿/小学教育

时间:2025-08-25

标签:无

格式:PDF

价格:10 玖币

-

小学二年级上册上学期-部编版语文:第一课时预习笔记

分类:幼儿/小学教育

时间:2025-08-25

标签:无

格式:PDF

价格:10 玖币

-

小学二年级上册上学期-部编版语文:第三课时预习笔记

分类:幼儿/小学教育

时间:2025-08-25

标签:无

格式:PDF

价格:10 玖币

-

小学二年级上册上学期-部编版语文:第二课时预习笔记

分类:幼儿/小学教育

时间:2025-08-25

标签:无

格式:PDF

价格:10 玖币

渝公网安备50010702506394

渝公网安备50010702506394